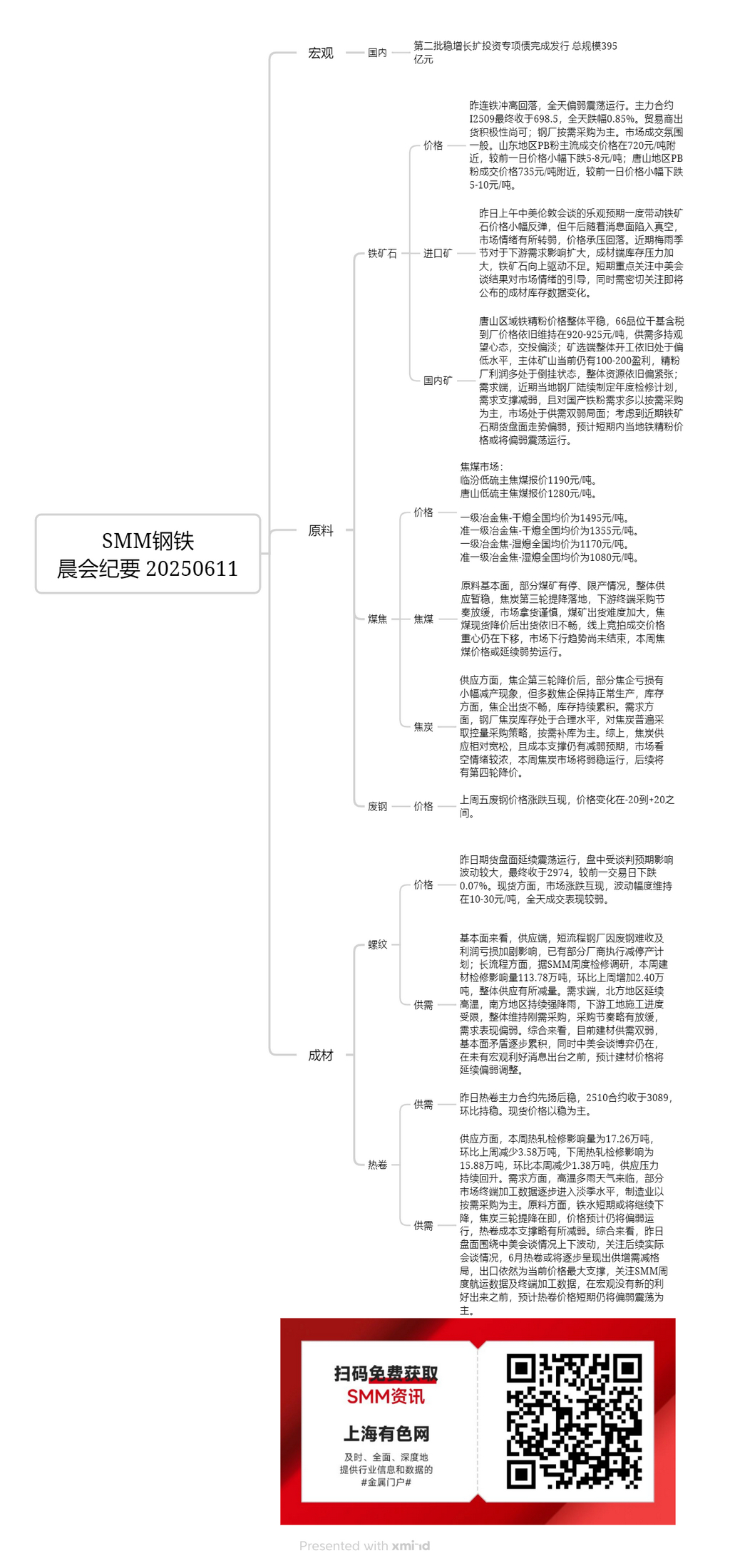

Domestic Ores:

In the Tangshan region, the prices of iron ore concentrates remained generally stable. The delivery-to-factory prices (dry basis, tax included) for 66% grade iron ore concentrates stayed at 920-925 yuan/mt. Both supply and demand sides maintained a wait-and-see sentiment, with trading activity remaining sluggish. The overall operating rates at mines and beneficiation plants remained at a relatively low level. Major mines were still making profits of 100-200 yuan/mt, while many concentrate plants were operating at a loss. Overall, resources remained tight. On the demand side, local steel mills have recently been formulating their annual maintenance plans, weakening demand support. Their demand for domestically produced iron ore concentrates was mainly based on just-in-time procurement, resulting in a situation of weak supply and demand in the market. Considering the recent weak performance of iron ore futures, it is expected that the prices of local iron ore concentrates will continue to fluctuate downward in the short term.

Coking Coal:

On the raw material fundamentals front, some coal mines have halted or reduced production, with overall supply remaining stable for now. The third round of coke price cuts has been implemented. Downstream end-users have slowed their procurement pace, and the market is cautious about purchasing, making it more difficult for coal mines to sell their products. Despite price reductions for coking coal spot cargoes, sales remain sluggish. The center of transaction prices in online auctions continues to move downward, and the market's downward trend has not yet ended. This week, coking coal prices are likely to continue in the doldrums.

Coke:

In terms of supply, after the third round of price cuts, some coke producers have slightly reduced production due to losses, but most have maintained normal production. In terms of inventory, coke producers are facing difficulties in selling their products, leading to a continuous accumulation of inventory. On the demand side, steel mills' coke inventories are at a reasonable level, and they generally adopt a strategy of controlling procurement volumes and restocking as needed. In summary, the supply of coke is relatively loose, and there are expectations of a further weakening in cost support. The market sentiment is bearish. This week, the coke market will be in the doldrums, and a fourth round of price cuts is expected to follow.

Rebar:

Yesterday, the futures market continued to fluctuate, with significant volatility during the session influenced by negotiation expectations. It eventually closed at 2974, down 0.07% from the previous trading day. In the spot market, prices showed mixed performance, with fluctuations remaining within 10-30 yuan/mt. Trading activity was weak throughout the day.

From a fundamental perspective, on the supply side, some EAF steel mills have implemented production cuts or suspensions due to difficulties in acquiring steel scrap and worsening profit losses. In the blast furnace-based production sector, according to SMM's weekly maintenance survey, the impact of maintenance on building materials this week was 1.1378 million mt, an increase of 24,000 mt WoW, indicating an overall decrease in supply. On the demand side, north China continued to experience high temperatures, while south China faced persistent heavy rainfall, limiting construction progress at downstream construction sites. Overall, just-in-time procurement was maintained, with a slight slowdown in the procurement pace and weak demand performance. In summary, the current building materials market is characterized by weak supply and demand, with fundamental contradictions gradually accumulating. Meanwhile, the Sino-US talks and negotiations are still ongoing. Before any favourable macro news emerges, it is expected that building materials prices will continue to fluctuate downward.

HRC

Yesterday, the most-traded HRC futures contract (2510) initially rose and then stabilized, closing at 3089, unchanged from the previous day. Spot prices remained stable overall. In terms of supply, the impact of maintenance on hot-rolled coil production this week was 172,600 mt, a decrease of 35,800 mt WoW. Next week, the impact is expected to be 158,800 mt, a decrease of 13,800 mt from this week, indicating a continuous rebound in supply pressure. On the demand side, with the arrival of hot and rainy weather, terminal processing data in some markets have gradually entered the off-season level, with manufacturing industries mainly purchasing as needed. In terms of raw materials, pig iron production may continue to decline in the short term, and the third round of coke price cuts is imminent, with prices expected to remain weak. This has slightly weakened the cost support for HRC. In summary, today's futures market fluctuated based on the situation of the Sino-US talks. Attention should be paid to the actual outcome of subsequent talks. In June, HRC may gradually exhibit a pattern of increasing supply and decreasing demand. Exports remain the biggest support for current prices. Attention should be paid to SMM's weekly shipping data and terminal processing data. Before any new favourable macro news emerges, it is expected that HRC prices will continue to fluctuate downward in the short term.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)